DISCLAIMER: CoC (Continuum of Care) is an alternative term for LTSS (Long Term Services and Support). Please note that not all instances of LTSS have been transitioned to the new designation.

To plan for financial stability, your CoC program should:

- Create a budget showing income and expenses—or estimating them, if your program is new.

- Determine the payers that contribute or will contribute to your program, like Medicare or other sources.

- Calculate how many patients your CoC program needs to serve to make enough money to cover operating costs.

These financial planning steps are explored in detail below.

Step 1-Create a Budget

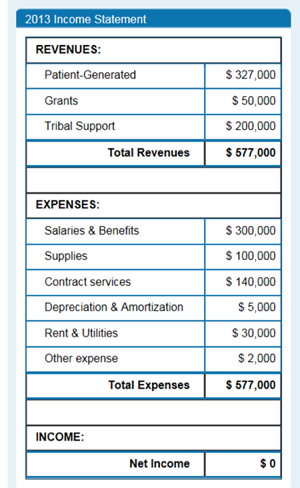

Income statements show revenues and expenses over a certain period of time and compare the totals of each item to figure out whether you lost resources or gained income during that time. The example below shows an CoC program income statement for a tribal home- and community-based services (HCBS) program.

Note: This income statement highlights some of the basic key components in an CoC program budget.

Source: Adapted from C. Harrison and W.P. Harrison, 2013, Introduction to Health Care Finance and Accounting, Clifton Park, NY: Delmar

Step 2-Determine the Payers

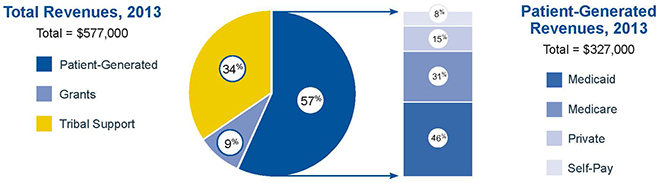

LTSS programs are commonly funded through multiple sources, called a “payer mix.” A pie chart like this one makes it easy to see how much each payer contributes to your program.

Revenue data pie chart showing an example program’s payer mix

In this example, patient-generated revenue from Medicaid, Medicare, self-pay, and private insurance makes up 57% of the pie. Tribal support is the next biggest slice, followed by grant funding.

Performance Targets

Once you have a current budget and a clear picture of your “payer mix” (Steps 1 and 2), you can set specific goals you want your CoC program to reach by a particular date. These financial goals are a type of goal called performance targets. Some example financial performance targets include:

- Increase total revenue to $750,000 within the next calendar year

- Generate 70% of total revenue from patient-generated sources by the end of the calendar year

- Increase Medicaid revenue to 60% of total patient-generated revenues within the next calendar year

Step 3-Calculate How Many Patients Are Needed

In the sample budget above, the program generates zero net income: it does not lose money, and it does not make a profit. This is known as breaking even.

Your CoC program probably will not break even at first, but doing a break-even analysis is still important. It shows you how many patients your program needs or how many billable services you need to provide to make enough money to balance program costs. If you know your program’s expenses, you can estimate the fewest patient encounters necessary to cover the costs of running your program.

Based on what reimbursable services are provided by your CoC program, you can develop target levels of patient-generated revenue from third-party payers, such as Medicaid.

Cost Considerations

Keep in mind that different types of CoC programs have different operating costs, such as those described in the following table.

Home- and Community-Based Services

Facility-Based Care

- Can often be provided at a much lower cost than facility-based care

- Fewer patients and services are needed to cover operating costs and break even with your budget

Tip: If your program does not serve enough patients to break even, consider employing staff and providers who split their time between the HCBS program and other tribal programs (like the tribal health clinic).

- Often has a much higher cost because facilities must maintain a building and provide 24-hour skilled nursing care

- A facility needs more patients (and more revenue) to break even

Tip: If the beds or rooms in your tribal facility are (or will be) under-utilized, consider including more services like transitional care to increase your occupancy level.

All content on this page was originally posted on the CMS.gov website here.